Worldwide supply chain solutions Inc has already been disrupted for several years due to escalating trade conflicts and the effects of Covid-19.

In 2021, it was all about scarcity. The shortfalls were taken over of COVID vaccination at the beginning of this year. It concerns that we would not purchase turkeys, toys, or electrical gadgets beneath the Christmas trees. Grocery shelves, auto showrooms, and even petrol stations were bare for most of the year. Some shortages were immediately rectified, while others persisted. So, are we in for an additional year of deficits, and would the supply chain solutions issue be resolved by 2022?

It’s worth considering that the shortfalls have occurred for several reasons. Throughout the early 2020 shutdowns, a sudden shortage of necessities left shelves throughout the world empty. Singapore, for instance, runs out of eggs due to consumer hoarding. Retailers purchased additional eggs in an attempt to meet rising demand. However, as the market completed, there was an unexpected surplus. Retailers threw out 250,000 eggs in July of that year.

It’s what occurs when demand fluctuates. The effect grows stronger with each layer of the supply chain, as each provider adds a buffer to their purchase to be safe. As a result, even minor changes in client demand might result in massive excess demand for raw resources. This is the bullwhip effect. A tiny flip of the wrist, like a whip, may result in a large boom at the other side.

The Ripple Effect:

The ripple effect may result from both rapid drops in demand and unexpected increases in order, and during the epidemic, both factors occasionally converged. For example, the semiconductor-chip scarcity was exacerbated by a combination of a drop in demand for new automobiles and increased demand for gadgets such as computers and gaming consoles (for lockdown pleasure).

Carmakers are critical consumers for chips, with current automobiles carrying up to 3,000 chips. However, as automobile sales fell in 2020, chip supply shifted to smaller electronic devices producers. When demand for cars resumed a few months ago, there were insufficient chips to go on. Covid forces the Carmakers to close manufacturing lines because they couldn’t produce enough vehicles to meet demand. They also began stockpiling chips, exacerbating the shortages.

According to Coughlin, the main concern for 2022 is how COVID-19 will continue to disrupt the supply chain. Factory shutdowns and labor constraints have already had a significant impact. It affects the producers’, distributors’, and merchants’ ability to get goods to market on time.

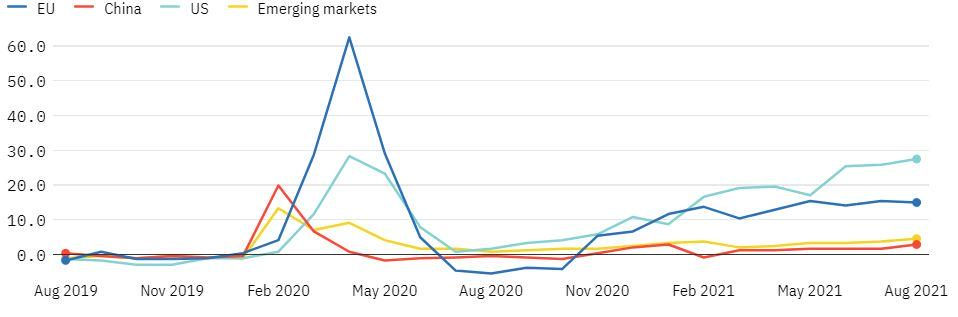

The EU and the US are still vulnerable to supply chain disruptions

August 2019–August 2021, supply chain index (100 = most disturbed).

As per the Statista Supply Chain Indicator, the US and EU are the most vulnerable to supply chain commotion. By August 2021, all regions showcased have been above the index 100 lines, demonstrating that disruption stayed high.

Food product scarcity

Labor shortages and issues with the 2022 crop planting season may keep costs high. Moreover, it supplies patchy for the remainder of the year, leaving grocery shops bare shelves.

The rapidly spreading omicron variety has disrupted operations at food production companies. An increase in ill personnel has increased company expenses and curtailed productivity.

Fertilizer and pesticide shortages have also caused growers to warn that crop yields this year may be lower. Soaring natural gas costs in Europe, along with export restrictions from Russia and China, are projected to maintain fertilizer demand high into 2023, according to an official with fertilizer company CF Industries, who spoke to researchers in November.

Shipping Shenanigans

Other inequalities exist in today’s supply networks beyond competing enterprises or industries. By sea, shipping containers transport around 1.9 billion tonnes every year, including almost all foreign fruits, devices, and equipment. Containers usually are loaded, emptied, and packed again, but trade interruptions caused by shutdowns and border restrictions disrupted that cycle.

Containers were left in the incorrect places when commerce moved, transportation capacity was decreased, and vessels were unable to arrive wherever and once they were supposed to. When combined with crowded ports and issues with timely loading and subsequent transportation, a typical cargo now needs 20% more time in travel than before the epidemic.

In this atmosphere, shipping costs have skyrocketed. Prices on major east-west shipping routes have risen by 80% year over year. Moreover, this would be bad news for the economy’s recovery. Even a 10% rise in container-freight charges can affect industrial output by roughly 1%.

The Human Factor

Although technological innovation has transformed the industry, production and distribution remain primarily reliant on people. Manufacture layoffs caused by lockouts resulted in labor deficiency when demand increased. For example, Vietnam could not readily reverse a significant flight of employees from industrial centers to rural regions.

Worker scarcity was especially noticeable among lorry (or truck) drivers in the UK and other nations. The industry has battled to attract and retain drivers because of increased demand, an aging workforce, and decreasing working conditions. However, Brexit has rendered it more difficult for migrant truckers to find work in the United Kingdom.

There have been apparent indicators of the driver shortage lessening in the take to Christmas as recruits entered the system. It may have contributed to product shortfalls being not as severe as they could have been. Therefore, we must not expect a quick resolution towards the supply chainissue in 2022.

As individuals take sick absences and vendors negotiate new constraints, the upsilon variant is causing more significant workforce shortages. China’s zero-COVID goal is anticipated to interrupt both manufacturers of commodities for the rest of the year.

However, we may also oppositely witness issues resulting from another strike of the bullwhip. Backorders will have been satisfied in many areas. Yet consumer preferences may be softening now that layoffs have finished and interest rates are starting to climb. As a result, various businesses may discover themselves with an overstock of items.

Some Final Words:

To prevent this, they must align their supply rates with demand. Nonetheless, demand may remain difficult to estimate, and not just due to omicron and China. A new strain of fear results in a new round of lockdowns. However, it might quickly end in people spending money on goods rather than vacations and evenings out. A supply chainwith actual demand and excellent interaction across supply chain levels will have a significant advantage. To summarize, several industries will face shortages and surplus issues during 2022.

The extent to which supply networks evolve is a longer-term concern. The epidemic cast further worries on the wisdom of offshoring production to far-flung countries with reduced labor costs. Similarly, measures to optimize supply chain effectiveness, such as just-in-time production, which requires corporations to maintain stocks to a bare minimum to save costs, exacerbated the problem.

How to improve supply networks more robust was a significant subject of 2021. However, increasing capacity, stockpiling goods, and preparing for interruptions are not inexpensive. As shipping bottlenecks clear and recruiting increases, talk of change may fade. Some businesses will most likely continue to enhance theirs only with a dash of just-in-case. Others will relocate specific product manufacturing closer to domestic markets while maintaining offshore production facilities to serve local consumers. It needs to be seen how much COVID can counteract globalization.

Finally, the Supply Chain Company is dominated by people, and 2021 demonstrated the system’s limitations. Current tangles will begin to untie as businesses and consumers adapt. However, as the epidemic progresses and the reality of keeping enterprises successful resurface, you shouldn’t anticipate a resolution around 2022.